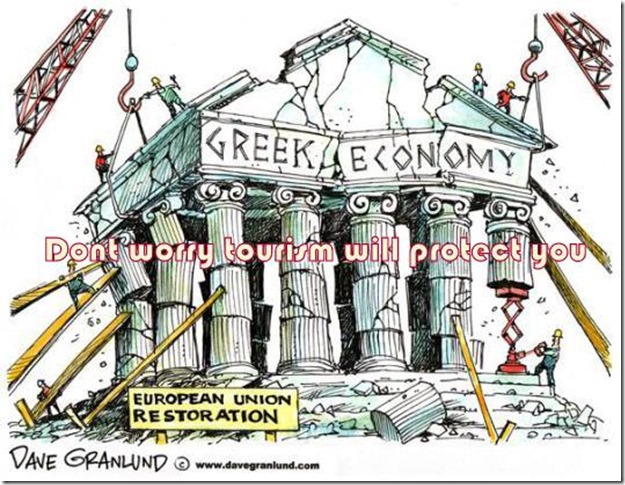

Greece Financial Crisis

Things about the Greek crisis you need to know

Greece’s long-simmering economic crisis has finally boiled over into a full-fledged political and financial breakdown. Banks are closed, Greek citizens’ are not able to withdraw hard cash from ATM, and a default on Greece’s debts to its fellow European countries looks overwhelmingly likely.

Before you blame anybody about this crisis, we bear to realize the underlying concept of this Euro Zone. The euro was established on 1 January 1999 as “an invisible currency, only used for accounting functions. On 1 January 2002, euro cash, replaced the banknotes and coins of 12 European countries (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain).

Today, the euro is the legal currency in the euro region, normally referred to as the Eurozone, formed out of 17 of the 27 Member States of the European Union (EU). Roughly €880 billion in cash is in circulation in the Eurozone.

The euro slumped in the first couple years after its launch, with a brief crash to $0.8115 in January 2002. Nevertheless, its value lasts closed below $1.00 on November 2002 (at $0.9971); thereafter, the euro’s value increased quickly, topping out at $1.35 in 2004 and making its highest value (versus the USD) at $1.5916 on 14 July 2008.10

Member of the Eurozone must abide by a Stability and Growth Pact, which has similar demands for the budget deficit and debt as the Maastricht criteria. However, some Eurozone countries have, without action from the EU, severely violated these criteria, resulting in a continental sovereign debt crisis and Greece was one of them.

The basic problem, nevertheless, is rather childlike. When a given country’s economy falters, one of the easiest ways for it to adjust is for its currency to decline in value relative to other countries’ currencies. This cuts the country’s citizens’ real purchasing power — there’s no getting around the bad news — but has the upside of boosting the country’s exports and tourism. A country that lacks this flexibility is much more likely to absorb economic pain by entering a prolonged period of mass unemployment. Which is what’s occurring in Greece today.

If you are planning a vacation in Greece, this is the best time to visit. At present, only increased Tourism can revive Greece out of this crisis. Besides, you have to consume large quantities of physical currency in both Dollars and Euros because ATM has limited amount of money and banking system is crippled. Besides, on that point is an opportunity for tourist to arrive a discount in rates as compared to official exchange rates because Greek individuals will face legal difficulties in turning their money into foreign currency. Just go up and hit it! It will be your cheapest vacation till date.